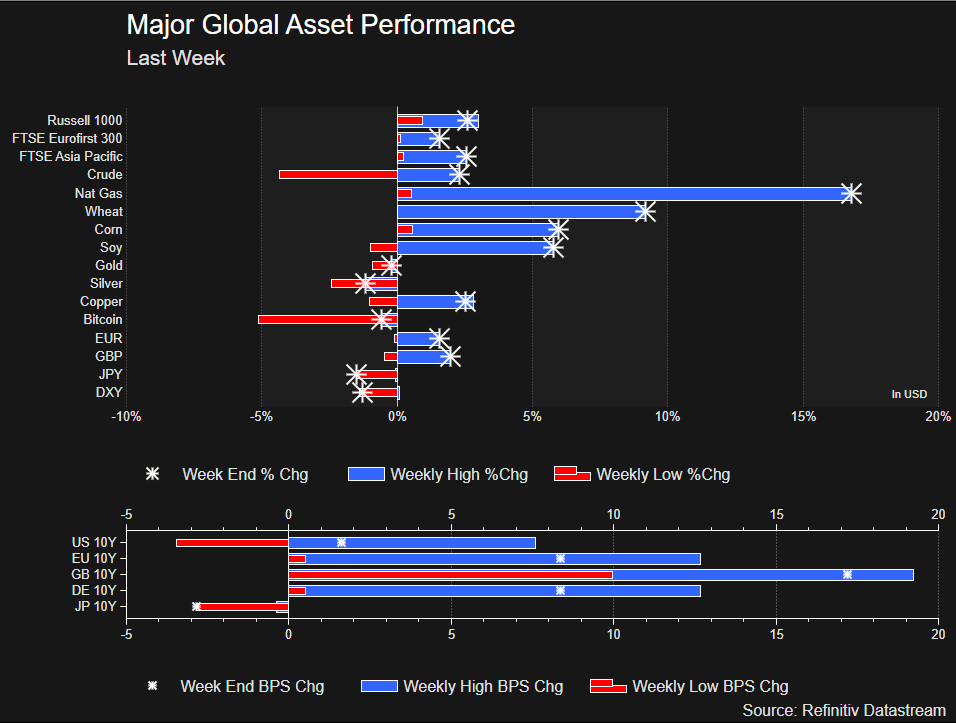

Another huge week in markets, especially my equities. South Korea's Kospi was the only market index I follow that was in the red last week. The U.S. was strong, led by tech again, but tech is leading most markets right now. Japanese equities continue their strong run and China joined the party in APAC too. They were all second fiddle to Argentina's Merval index, which was up 7.2%. Equities weren't the only asset classes to finish with a solid week. Many commodities ended the week up.

Palo Alto Networks was added to the S&P 500 on Friday. It was a fun afternoon to watch the volume going up. It started heavy trading a bit after 2PM. The middle chart is the buyers (blue) versus sellers (white) from 2pm till 3:30, you can see the sellers were out in force. One the far right, you see that same chart from 3:30 till the close, where the buyers started to take over. The last 5 minutes though was a bit of a stalemate. This reminded me of trading these events, as well as sending these orders out to be traded when I was on the buyside.

Friday's volume in North America was strong, but not quite the same as we saw for the Q1 quad witching / rebalance trade.

Another big week coming for volume, even with the off day in U.S. markets on Monday. Russell reconstitution is slated for Friday. A couple of my colleagues joined Anthony Crudele to talk through the process and share some interesting charts. Catherine and Indrani were joined by Paul Woolman, from CME, and Rick Rosenthal from Cboe to highlight other impacts of the event on trading.

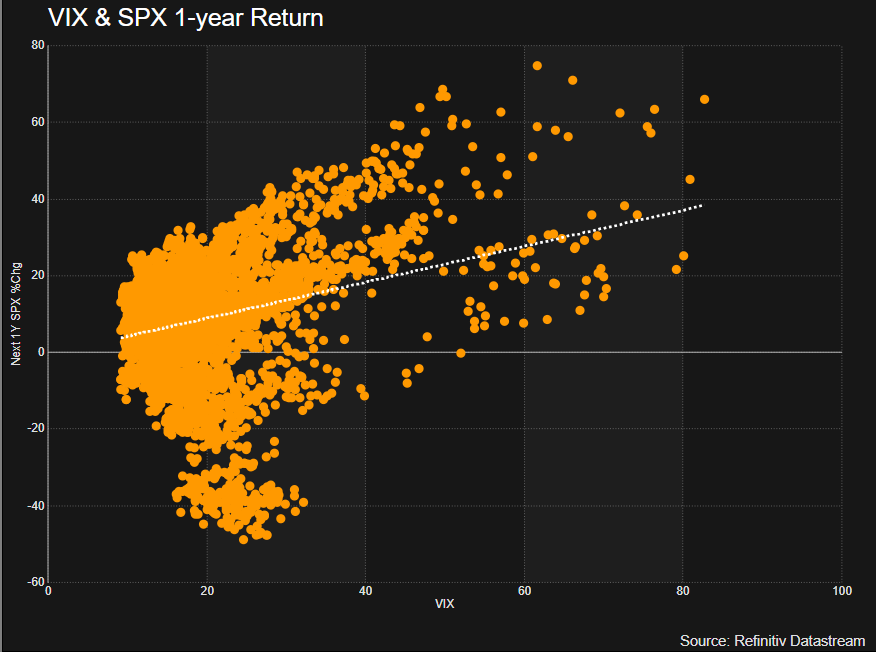

One last bit before we get into the content, the CNN Fear & Greed is quite high right now and the VIX is relatively low.

Best of the Week

This was a surprising one for me. Kelly Shue presents Stephen Dubner with some research that typically ESG investing might not be doing as good a job helping as investors might think. In this thought provoking episode we hear from two shops with an ESG lens to investing, Carine Smith Ihenacho of Norges Investment on their strategies around ESG and Chris James, CIO of Engine No. 1, and how they differ. The research done by Kelly shows that ESG is more about feelings and that with ESG, it's more about the E than anything. She notes that Brown firms, which are those in the top 20% of greenhouse emissions per unit of sales, could benefit us more by cutting 1% of their impact than green firms can by cutting 100%. We also hear from CEO of CF Industries, a brown firm, who says current costs of capital make it less likely investments will happen to make things greener. This is really an amazing episode and made me rethink my opinions on green investing.

Are E.S.G. Investors Actually Helping the Environment? - Listening time: 55 minutes

Best of the Rest

This one is a long one, and for people interested in the risk and diversifying portfolios based on based on risk. Jason J. Josephiac & Ryan Lobdell, CFA, CAIA joined Adam Butler & Rodrigo Gordillo to chat about their new white paper. Jason and Ryan work on the Marketable Alternatives team, which is a rebranding for Hedge Fund, at Meketa Investment Group. There's a lot of sports analogies here around offense and defense, and the Dennis Rodman example. The guys walk through risk mitigation, leverage, portable alpha, and using private investments to have a better portfolio.

Risk Mitigating Strategies with Jason Josephiac and Ryan Lobdell Listening time: 84 minutes

I like the point Josh is making here around the reasons for market moves are not often what we think they will be.

Eight Simple Truths you will have to get comfortable with from The Reformed Broker

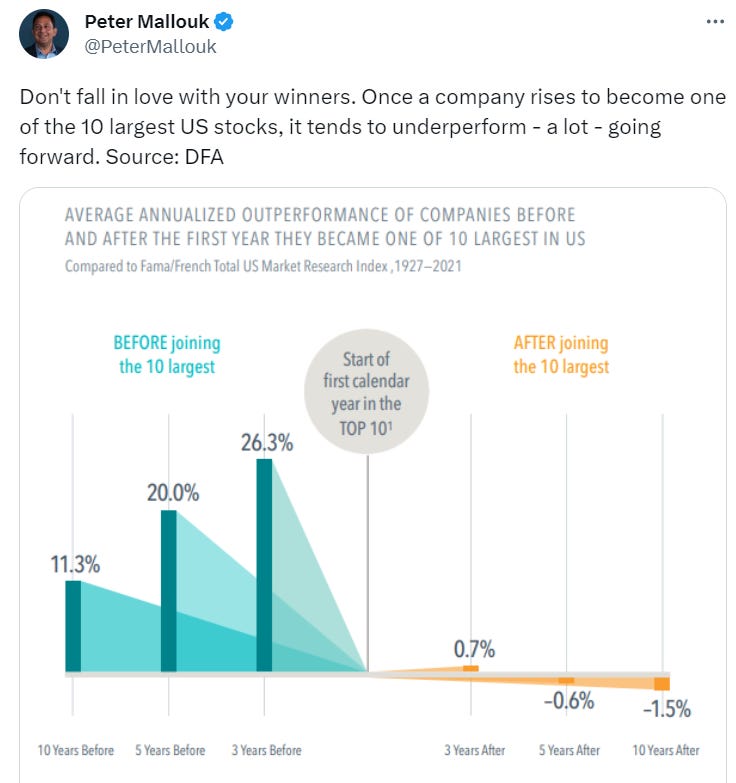

Good share of some DFA info from Peter here.

What happens to names after names make a big run

I talked about the liquidity issues coming with the Fed's need to raise cash. I thought this article shows us what the plumbing looks like.

Intriguing conversation Anthony "Pomp" Pompliano had with Bill Clerico around investing to solve wildfires. Bill is looking for companies that can help stop or improve the impacts of wild fires. He mentions that 8 of the 10 most destructive wild fires have happened since 2017. He's looking for things like building with different materials, improving detection, and helping prevent or reduce the impact of these events.

Bill Clerico on investing to Solve Wildfires - Listening time: 33 minutes

One for the Road

Being Father's Day, this one is for my dad, who is a huge Beatles fan. It's also probably the first news he thought about how AI can help him. I'm pumped to hear this "new" song.

AI used to create new and final Beatles song, says Paul McCartney