This week was a mix. When I wrote this, I was sitting at the beach. We took a last minute weekend getaway. Luckily, I had some warning, so I had been writing up what I could during the week.

Lots of red again last week across major assets. Nat Gas continues to be volatile. I'm now starting to look at Bitcoin a little more. Not sure why it would be up last week. Yen, and Japan in general, is another area I'm keeping a close eye on.

Earnings Watch

Earnings' Season is about three quarters of the way through. Performance has been mixed in almost every aspect. Companies have beat on Earnings 56% of the time and Revenue 52% of the time. Year on year growth is showing down for both, next quarter revisions are also down for both. Across the 8,500 companies that have reported, there have been over 16,000 downgrades. Below I took a look at breakdowns by geographic region and sector.

The geographic region duplicates some countries, as they appear in a few different regions.

Emerging Europe has beat on Earnings 64% of the time and Revenue 59% of the time. Current quarter Earnings beats surprised by +14%, but still -17% on YoY basis and -3% on revisions.

Developed APAC has some decent YoY earnings' growth of 8.6%

Europe hasn't performed well, no matter beat or miss

On a sector basis, a few things stand out to me.

Consumer non-cyclicals have beat the most on the bottom line at 62%

Basic Materials have only beat revenue estimates 29% of the time.

Industrials have a huge drop in earnings revisions if about -60%

Tech beats are down on average after two days

Here's a quick Reuters' article on how options bets around earnings are working so far. It's from the beginning of last week, so the performance doesn't include last week's results. Matt Amberson and team do a wonderful job with this data. Through the first two weeks, actual moves are more volatile than implied. The ORATS data shows the moves are about average, but the options have been pricing in less volatility before hand.

Options bets on earnings-fueled volatility in US stocks paying off

Best of the Week

Robin Wigglesworth is one of the financial industry's great writers. He always does a wonderful job of knowing the right length of story to cover a topic. This one covers over 1,000 years of history. He has some quote from the Bond King himself. I loved how Venice's one time load turned into a never ending borrowing facility. He walks us through Michael Milken's world of junk bonds and corporate raiders. The article also takes us back to the securitization phase of the mortgage market led by Lew Ranieri. My favorite story though was the birth of the now infamous Eurobond market. It's astounding that a $30T market started with a mear $15m bond sale in 1963. Robin also covers the Shadow banking industry, COVIDs impact, and the importance of the U.S. government debt to the market.

How Bonds ate the entire financial system

Best of the Rest

This is a new series from LSEG's FTSE Russell team. In this conversation, Indrani Dr, who is the Head of Global Investment Research, joins the set to talk through a number of major topics in the news today. The conversation touches on the Dollar and why it isn't weaker. I found Indrani's points on the strong tech economy in U.S. to be insightful. She mentioned that the current AI craze might be the start of the next tech boom. Her views on China's impact on global inflation was a topic I found interesting. Of course, they discuss inflation in the US as well. Jamie's question if the Fed has an actual plan or is playing it off the data. Indrani mentioned more than once that we should be done or close to the end of the hiking cycle. My favorite point comes towards the end of this chat. Indrani noted that EM debt today is much different than their history. Rate hiking hasn't set them into a stress period. Another point she makes is that EM equities linked to China is about 50%, so that's a big part of the reason they haven't recovered. There's so much info in this short session. Watch time: 16 minutes

The longer view for financial markets from FTSE Russell

This makes two articles from the FT this week, but as we start to see more companies defaulting, Credit-default swaps become an important part of the trading markets. FT highlights some data coming out of a Barclays report that shows CDS volumes up 62% in H1 this year.

Credit Default Swaps are so back

I thought I'd share this article because it highlights the change coming to institutional trading desks around automation. I moderated a panel on automation in fixed income trading recently and mentioned that most people see automation as the Boston Dynamics robots, but I see it more like the mechanized robot suits in the Matrix. Automation and other LLM will help traders do more in less time, just like algos did 20 odd years ago. Have you ever manually sent orders to attempt to match VWAP on a list of 500 names over the day? I have, and it was painful.

Buy-Side Perspective: Embracing innovation and automation – the future of buy-side trading desks

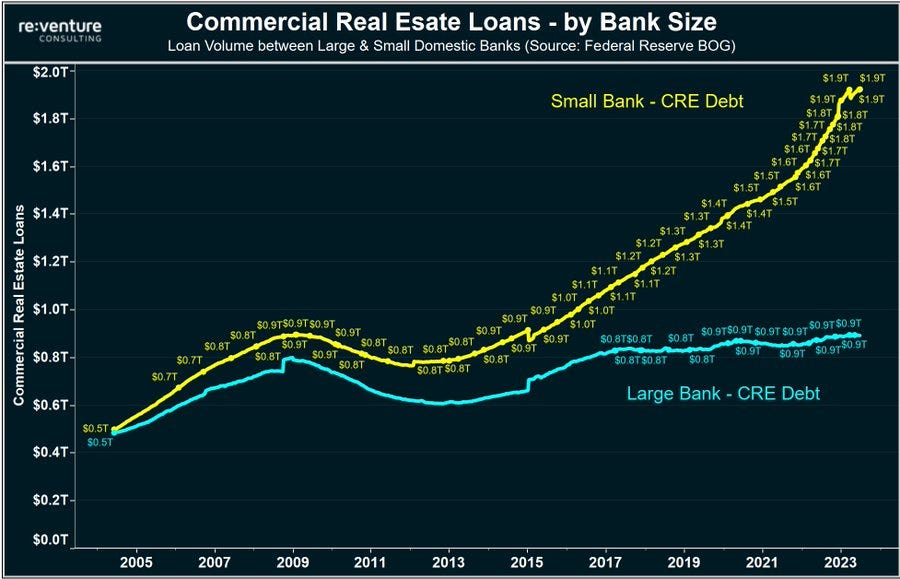

Excellent post on bank exposure to commercial real estate loans. Not much to add from me, except that these are much larger than I expected.

One for the Road

Yet another amazing Wayne Gretzky story. Billy does a wonderful job of finding these things. His basic takeaways were. Find and study those who found ways to excel without the traditional success characteristics and advantages, and watch or listen to those you would like to emulate over and over to learn, a process called introjection.

Billy Oppenheimer on Wayne Gretzky

Thanks for reading. Make sure those in the northern hemisphere enjoy the remainder of summer.