Scenario

I've been away for a while. To be honest, I hope you missed me. I've been sitting on 99 editions for a while. I wanted to make 100 something special, but decided to just keep it 100. This is already a best of blog, so no need to look back. We've got enough going on now that I can stay on current markets. I think investors and traders are asking "What's the Scenario?" an awful lot of late. Whether it's President Trump, Elon Musk, some other member of government trying to make a name for themselves or the opposition reacting them, it's been lively.

Over the last month, while I was away, markets have been wild.

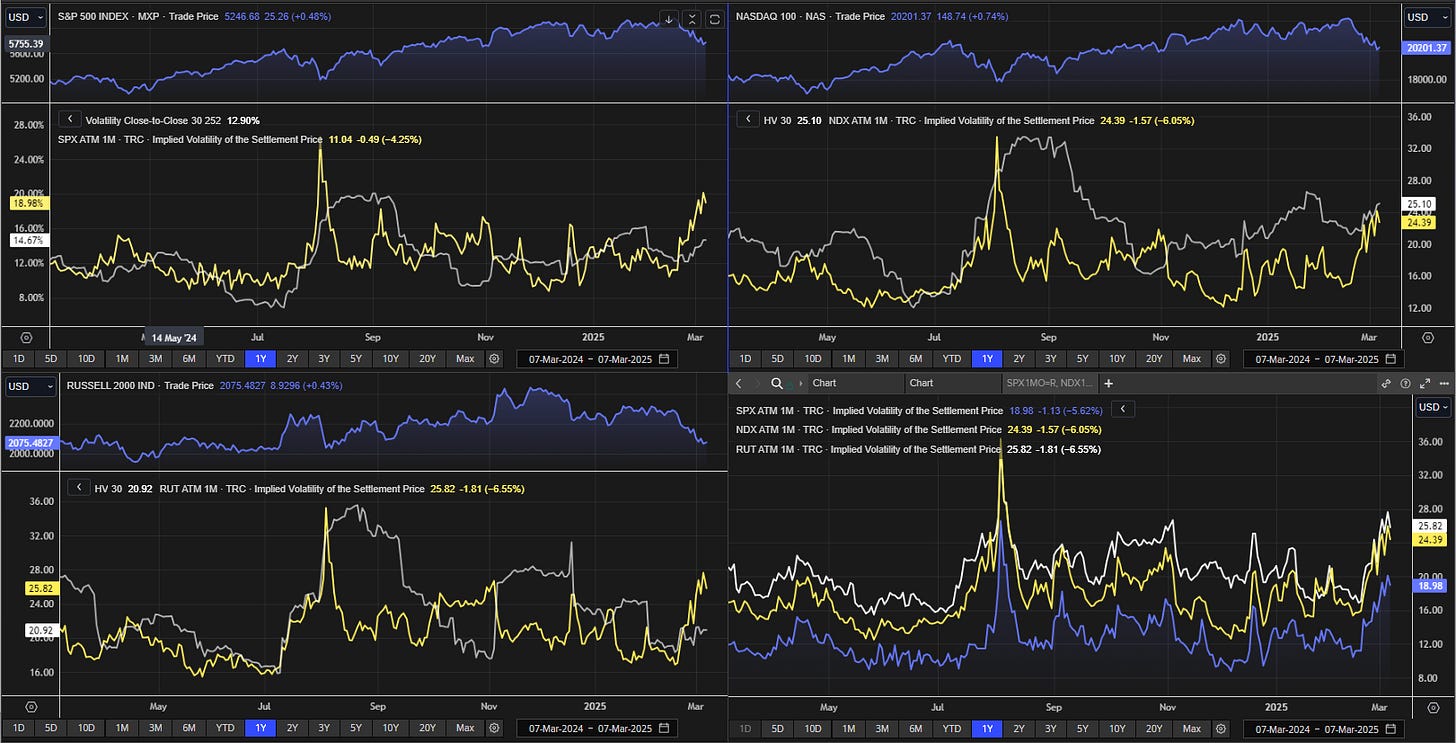

Let's look at a few interesting charts I've been watching while I was away:

Every day last week but Friday the Russell 1000 moved more than 1% on the day. In the last year, the index moves +/-1% about 20% of the time, so this is a little more than normal. There's also a lot of big candles there as well. I'm also watching how it reacts to the 200 day moving average.

German rates are spiking. Here I zoom out a bit to look at a two year chart, so you can see that we're not above the October 2023 levels.

The final chart is a bit of preview to one of the articles below. I'm looking at the historical volatility of the S&P 500, NASDAQ 100, and Russell 2000 indices. You can see the implied vols elevating as markets move lower. The NASDAQ is the only one were the realize historical vol is higher than the implied vol.

Best of the Week

Joachim Klement's article, "The Index Inclusion Effect Is Dead," challenges the belief that a company's inclusion in a major stock index, such as the S&P 500, leads to sustained positive performance. Historically, being added to an index was thought to boost a company's stock due to increased demand from index funds and enhanced visibility. However, recent analysis shows that companies are selling new shares into this boost in demand to buy. Companies going into the S&P 500 are issuing roughly 1% of their shares the day after the inclusion. They've also smartened up to hedge funds buying into this event as well. Companies are issuing up to 0.5% per day in the two weeks between the announcement of inclusion and the actual event. The diminishing effect of index inclusion carries implications. Investors need rethink strategies that rely on index inclusion as a marker of potential success. There's actually a story out there about Millenium losing close to $1B on their index rebalancing strategy. Companies removed from indices might present undervalued investment opportunities, challenging the conventional avoidance of these names. The shift also underscores the importance of measuring intrinsic value rather than relying solely on index status.

Best of the Rest

In the latest episode of the Equity Mates Investing Podcast, titled "Volatility is Back, So Are the Opportunities," hosts Bryce and Alec sit down with Sebastian Mullins , Head of Multi-Asset and Fixed Income, Australia at Schroders. Seb discusses the recent turbulence in global markets, highlighting how initial investor optimism following political events led to significant market gains, particularly in the U.S. However, this was followed by corrections, especially in tech-heavy indices like the Nasdaq, while European and Chinese markets experienced substantial growth. He emphasizes that such volatility is becoming the new normal, suggesting that investors should embrace these fluctuations as they often present valuable opportunities. Seb advocates for a renewed focus on stock picking, implying that careful selection can lead to success in these unpredictable times. Throughout the episode, the conversation revolves around strategies to navigate and capitalize on volatile markets, offering insights into how investors can adapt and thrive amidst uncertainty. I liked Seb's points around embracing volatility to buy quality at a discount, shifting to active stock picking, keeping a longer term perspective, and diversifying across asset classes and geographic markets. Listening time: 39 minutes

Volatility is back, so are the opportunities - Seb Mullins | Schroders

Sharing this one as a bit of a homer, but it is very good. In the latest episode of the LSEG Data & Analytics Hedge Fund Huddle podcast, titled "The Psychology of Trading – Breaking Down Emotions and Personalities," host Jamie McDonald initiates a series exploring the psychological aspects influencing trading performance. He is joined by Dr. Richard Peterson n, a psychiatrist and CEO of MarketPsych, and Dr. Alden Cass, a licensed clinical psychologist and trading performance coach. The discussion delves into various personality traits commonly observed among hedge fund traders, such as confidence, competitiveness, discipline, introversion, and anxiety. The conversation emphasizes that while certain traits can enhance performance, others may hinder success. A significant focus is placed on managing emotions effectively, particularly anxiety, and understanding herd psychology to navigate market bubbles and crashes. The experts suggest that traders can transform anxiety into a motivational force by developing strategies to manage it constructively. The episode also touches upon the importance of self-awareness in identifying one's suitability for trading roles. The guests discuss the utility of personality testing in the hiring process and highlight the need for firms to recognize how individual traits can impact team dynamics and overall company culture. They caution that unmanaged anxiety in leadership can negatively affect the work environment, underscoring the necessity for effective emotional management. Listeners are encouraged to reflect on their own emotional responses and consider how these can be harnessed or mitigated to improve trading performance and personal well-being. The episode offers practical insights into the psychological factors at play in trading and provides guidance on optimizing both professional success and personal happiness. This is the first episode in a series on psychology and emotion in trading and investing. Listening time: 47 minutes

The psychology of trading – Breaking down emotions and personalities

This is a good one from Tom McClellan on a VIX indicator. VIX futures contracts represent traders' projections of what the VIX Index will be at specific future dates. Unlike the spot VIX, these futures do not react as sharply to immediate market movements, making them useful for establishing a baseline to identify when the VIX Index might be exhibiting overly exuberant or complacent behavior. McClellan shows two charts one that measures the highest price of the futures contract spread with the VIX. When this indicator goes negative, as it is right now, that says the VIX Index is currently above all of its futures contracts. This is a fairly rare condition, and indicative of a bottoming condition for stock prices. But he notes that this doesn't always mean the bottom is here, as it can take a while. The chart below shows the highest priced contract inverted and when there is a divergence between it and the S&P 500 that it's time to pay attention. This doesn't mean a top has arrived, but McClellan notes that we may be building a more significant top. So you can see we've got some diverging indicators and I'm sure there's more. It's time to reduce your size and pay close to attention to everything you're doing.

In keeping with a warning message of a possible top, Bridgewater examines the exceptional performance of U.S. equities over the past 15 years. In their paper "Investing in a New World: Capturing Opportunity and Weathering Uncertainty," they discuss strategies for investors to maintain robust returns amid evolving global dynamics. Over the past 15 years, U.S. equities have experienced unprecedented growth, with returns more than double the historical average. This period stands out as the most lucrative for equity investors since 1970, characterized by a relentless upward trajectory where market dips were swiftly followed by recoveries. Currently, investor portfolios are more concentrated in equities than at almost any other time, with the only comparable period being the peak of the dot-com bubble in the early 2000s. This concentration implies a collective bet on the continued strong performance of stocks, particularly U.S. equities. However, this remarkable performance has elevated valuations, embedding lofty expectations into current prices. For investors to continue realizing substantial returns, U.S. companies must not only meet these high expectations but surpass them—a challenging prospect. The paper highlights that the exceptional returns of the past were partly fueled by favorable conditions, such as declining interest rates and globalization, which may not persist in the future. Given the uncertainty surrounding the sustainability of past returns, Bridgewater emphasizes the critical role of diversification in investment strategies. Relying heavily on a single asset class, like U.S. equities, exposes investors to significant risks if those assets underperform. Diversification across various asset classes, geographies, and investment strategies can help mitigate these risks and enhance the resilience of investment portfolios. The paper acknowledges that the investment landscape is continually evolving, influenced by factors such as technological advancements, geopolitical developments, and economic policy changes. To navigate this complex environment, investors are encouraged to adopt flexible strategies that can adapt to changing conditions.

Investing in a New World: Capturing Opportunity and Weathering Uncertainty

One for the Road

This podcast Adam Grant talks with Erin Meyer about how to explore how cultural norms impact workplace interactions. The conversation delves into how different cultures perceive and practice honesty and assertiveness. Meyer and Grant analyze common stereotypes about Americans, discussing the cultural and psychological factors that contribute to these perceptions. They offer advice for those that have global roles. The top one for me is to recognize there are cultural differences to start, but there's also adapt approach to feedback, observe & learn below assuming, strike a balance between local and global practices, be flexible, and ask questions. I found this one very helpful for me, who is very American and has to work with many different cultures. I do think realizing how aggressive I can be does help some. Listening time: 46 minutes

Decoding cross-cultural communication with Erin Meyer

Thanks for reading. I don't expect to be away for a month again, but do expect some travel on my end that will make this more semi-regular for a bit.

Michael