Equites took a bit of a beating last week, almost across the board. Asia Pacific led the way lower and the Hang Seng was the worst of all the major indexes ending the week down almost 6%. Europe was quite even across most country indexes. Norway was off about 4.5% and the Netherlands was the "best" down only 2% on the week. North America was the best performing with major large cap indices down only about 1.5%. Smallcaps and Canada were a little worse. Markets were not helped at all with the continuation of the Fed hawkish talk and the hikes from central banks in England, Switzerland, Norway, and Turkey. This is where the title comes from. It's a 1989 song from American punk/alt rock band, Red Hot Chili Peppers. The chorus echoes the economy and world Central banks, "if you see me getting mighty, if you see me getting high, knock me down, I'm not bigger than life." Though I think we might "Taste the Pain" in the short term. Eventually, I think we catch "Fire" and make our way to "Higher Ground".

In other markets, crude continues to stall and even drift lower. I've got my eye on the Ags now after hearing Leigh Goehring's points below. They had a solid week, except corn. Bitcoin was the outperformer of the week closing last week (Friday) up more than 15% on news Blackrock's ETF filing.

Fun on Friday was tracking the Russell 3000 changes. I focused on the new additions. The volume in those nearly 300 names going in to the index. I posted on the performance of these names YTD compared to the overall index. Below is the top names by turnover on Friday. Most names had significantly higher than normal turnover, which is not much of a surprise. Some names trades as much as 15x their normal volumes.

Best of the Week

Robeco shares some insight around improving risk-adjusted returns for their multi-factor credit funds by adding machine learning language models to better analyze bond valuations. According the article, value has been a key factor of the fund’s performance. Value in bonds is essentials investors overreacting to bad news, then profiting from the bonds return to fair levels. The challenge with value is avoiding the ‘value traps.’ Part of the measure of value is comparing to bonds with similar credit ratings and maturities. The challenge with this, as the Starmine team at Refinitiv have also found, is that credit rating agencies are slow to respond to new information. Robeco has been working to enhance their strategies, especially in the high yield space to filter our value traps, by using regression trees via machine learning to exploit relationships and patterns between risk measures. As I mentioned, the Starmine Quant Research team at Refinitiv has aimed to offer something in this space. The Combined Credit Risk model, which I’ve highlighted in below screenshot allows for a much faster frequecy of ratings updates and can be a good indictor for both equity and credit investors. For my screenshot, I’ve picked a random high yield bond issue and compared that to it’s issuer credit rating in the model. You can see with Petrobras the underlying has a rating of junk (BB-) but the model has the parent as an A rated company. While not a perfect comparison, I want to show an example of how the Robeco models could work in theory.

The next frontier in value investing in credits: integrating machine learning

Best of the Rest

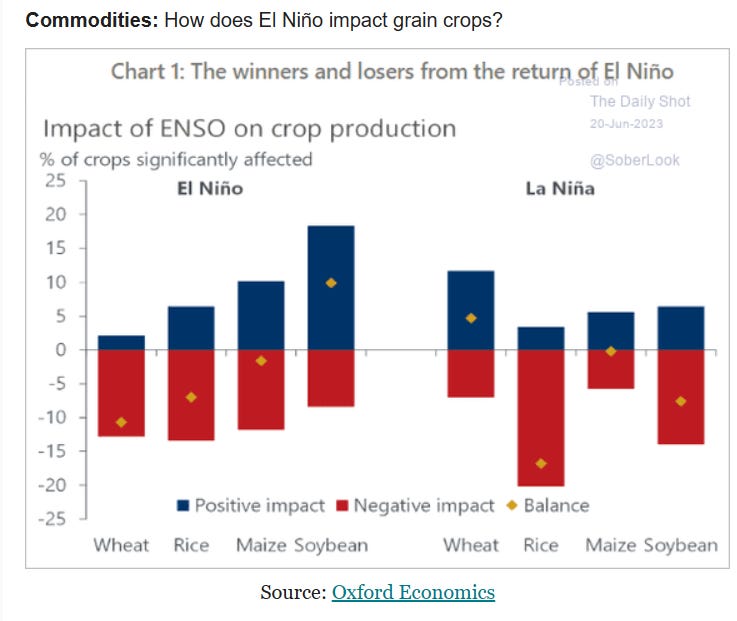

This was a fantastic and enlightening conversation. Leigh is the cofounder of Goehring and Rozencwajg. He joined Erik to discuss his prognosis for severe food inflation coming. He talks about the two major factors that will push them higher. The first being the rise in per capita GDP that is moving people from starches to animal proteins, and the second is adverse weather patterns. Leigh mentioned that we're in a declining sun spot cycle, which doesn't bode well for global weather. He thinks we're about to move into a transition between El Nino and La Nina, which may result in dust bowl like conditions. I've shared a chart that happened to appear in the Daily Shot this week from Oxford Economics around the impact on crop production from weather. Food inflation has been a nuisance for developed markets recently, but conditions will cause low income countries to suffer severe caloric droughts. This will also increase food nationalism. They referred to the recent rise in grain and other ags around this. He noted supply is also constrained, because prior to the war Ukraine accounted for 10% of wheat and 5% of corn global exports. Those have dropped 50% and 40% respectively. One final point to share for those in equities, he actually prefers fertilizer stocks better than anything because of these conditions. This conversation worried me a bit. I was also surprised about some of the forecasts and how the impacted different regions of the globe. Listening time: 64 minutes (Interview is 41 minutes)

Leigh Goehring: Global Food Crisis Update

Another solid conversation around AI and machine learning. Professor Daniel Rock came down to the Behind the Markets studio to chat with Jeremy and Dr. Siegel about how AI will impact jobs and productivity. Daniel thinks that the quick shift in the market caught many by surprise, but he believes that the 40% estimates of job loss are overdone. He does think it will impact jobs, but not full loss of work. There will improvements in marginal product of workers, but that may not translate into cost savings for companies. The did mention a Paul Krugman quote that "Productivity isn't everything, but in the long run, it's almost everything. I did Professor Rock's response when Jeremy asked about how he's changing his grading to account for ChatGPT. He mentioned As now require originality and correct responses. He does think that GPT will help product interesting and original thinking. Listening time: 53 minutes

Behind the Markets Podcast: Daniel Rock

Keeping to a sort of theme this week, this Traders Magazine article refers to the challenges this technology will face getting used in the world of capital markets. Essentially, data privacy, knowing how to use it effectively, inconsistency of output, and lack of the ability to explain the results are the big four for rough roads. I'm not sure I agree with all of this. The technology will eventually be able to work with the data you offer it, so I think we'll see that help. Being able to ask questions is what the majority of these teams do best. I'm not sure I see the reasoning there. The last two I can see as good possible reasons, but I also might be off on the first two. Either way good post on the thoughts from Emanuele.

4 Reasons Why ChatGPT Isn’t Ready for Prime Time in Capital Markets

A lot of learning of this week for me. This post from Dan was something I've never thought of, volatility of revenue and profits. I mean it's a bit obvious when it's brought to your attention, but not something often thought about. Dan uses data over the last 30 years to look at income statement volatility. He shows that it's actually persistent and predictable. The thing he does find though is that this does not translate into valuations in a predictable way.

With a recession looming for more than a few months now, many traders are trying to call the top and getting burned. The WSJ article that this link is highlighting mentions some incredible stats from S3 Partners. The $120B loss might be expected with the currently bullish trend and the fact that total short interest topped $1 Trillion this month. That $1T number is up about 15% since the begging of the year and equals about 5% of all shares available.

One for the Road

The numbers here are staggering. I haven't paid much attention to the size of these television deals, but they seem to be driving the big schools revenue higher and higher. Ohio State comes in at number one and has revenues of more than $250M for the year. That puts them in the same ballpark as names around 2500 in the Russell 3000. While the revenues do not translate to any actual profits, that's not the objective of these "businesses." Yes, I meant that.

SEC, Big Ten each top $2 billion in athletic department revenue, outpacing Power Five foes

Thanks for reading. By the Way, fight like a brave we can't stop and don't give it away now.