Apparently, the people in Washington heard the cries from ABBA, as a US government shutdown was averted at the last minute. It was weighing on markets last week. It was a bad week that came at the end of an awful September, which closed out an ugly third quarter. Almost every major equity index is lower. Here are the few that are in the green in the last month; Norway (Oslo SE +1.7%), UK (FTSE 100 +1.9%), and India (Nifty 50 +1%). There were a few more that are positive when we look at the quarter, but Q3 wasn't great on the equity front. Bonds are much of the same. Whether it's developed government, EM, corporates with any credit rating, most bond indices dropped. The only one I found to be in the black was IBOXX Sterling Corporates. The rest of FICC was spilt. Most commodities were down as well, but Crude was up huge and NatGas up a bit. In the currency space, the Dollar index was up mostly on strength against the Euro and Pound. Most other currencies were strong against the Greenback. Bitcoin sort of spans that currency / commodities space, but it was one of the worst performing assets in Q3, dropping more than 11%.

Best of the Week

Jeremy Grantham joined the Michael and Josh and this was an awesome conversation. There's so much in this nearly two hour conversation. Josh starts with asking Jeremy about the founding of GMO coming off his time with Batterymarch. The guys discuss quality investing, inflation, the magnificent seven and how they differ, recession, Elon Musk, but there's so much packed into this. One of my favorite of any podcasts of the year. Listening time: 111 minutes

Best of the Rest

The All-In Summit had some heavy hitters. I haven't gotten thru them all, but a few people recommended this Bill Gurley talk. I found it super engaging. Bill talked through some of the more disturbing things about regulation and lobbying that impact private equity investing. He just destroys the problems with money in politics and how it benefits the incumbents. Watch time: 36 minutes

All-In Summit: Bill Gurley presents 2,851 Miles

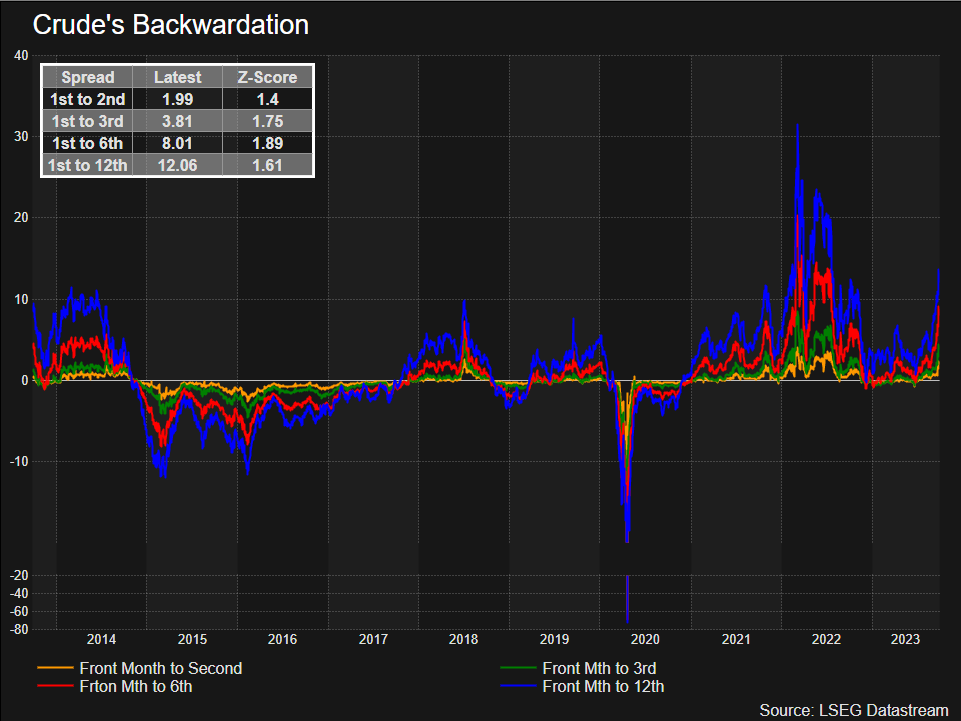

This HFI Research piece walks through the falling storage numbers for crude in the US. This along with cuts from OPEC+ will send the market to the moon. The article mentions the backwardation and I've expanded on their charts below with a few more spreads further out on the curve. Some of them are getting out there. Now, the last few years showed us things can get even crazier. They think oil will continue to climb even with worries of recession, high rates, margins, and spare capacity. The

This Is No Time For Celebration, The Oil Rally Is Just Getting Started

One for the Road

I forget who shared this one. I think it might have been Meb Faber. It's an old talk from Peter Lynch at a FRB (that's Friedman, Billings, Ramsey for those that forgot) Communicating Capital Ideas conference. The video is from C-SPAN, which I also found funny. Peter talks through some of his most famous mantras, like own what you know. His ten most dangerous things people say about stocks was must listen. He mentions a ton of old names there. Listening time: 47 minutes

Peter Lynch Lecture On The Stock Market | 1997

Thanks for reading. Have a great week.